Generic Drug Reimbursement: What You Need to Know About Coverage, Costs, and Alternatives

When you hear generic drug reimbursement, the process by which insurance plans pay for lower-cost versions of brand-name medications. Also known as generic medication coverage, it's the quiet backbone of affordable healthcare in the U.S. and many other countries. It’s not just a line on your pharmacy receipt—it’s a system that decides whether you can afford your daily pills. Most people assume generics are cheaper and therefore always covered, but that’s not always true. Some plans limit which generics they reimburse, require prior authorization, or even push you toward a specific manufacturer’s version—even if it’s the same active ingredient.

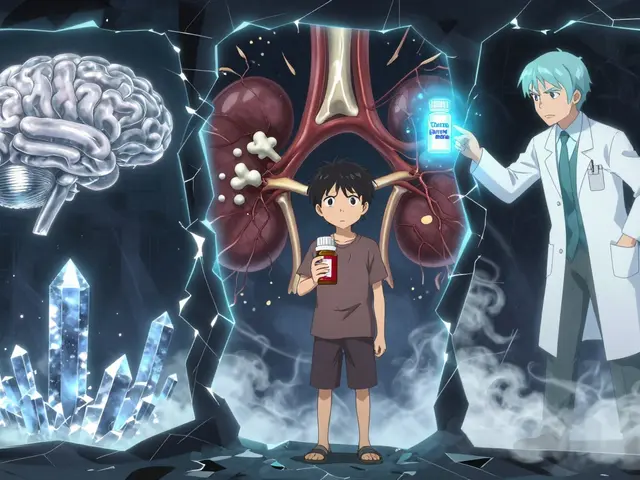

Behind every generic medication, a drug that contains the same active ingredient, strength, and dosage form as a brand-name drug but is sold without a brand name. Also known as generic drugs, it is a cost-effective alternative to brand-name prescriptions. is a story about insurance rules, pharmacy networks, and sometimes, surprising gaps in coverage. For example, if you’re on levothyroxine, your plan might reimburse one generic brand but not another—even though both are chemically identical. Why? Because the manufacturer paid for preferred placement. That’s not science—it’s business. And if you’re managing high blood pressure with diltiazem or diabetes with metformin, you could be paying more than you should if you don’t know how your plan handles reimbursement tiers.

insurance coverage, the extent to which a health plan pays for medical services, including prescription drugs. Also known as prescription drug benefits, it determines whether you pay full price, a copay, or nothing at all. doesn’t always match what’s listed on the drug label. Some plans use step therapy: you have to try the cheapest generic first, even if your doctor knows it doesn’t work well for you. Others cap the number of pills you can get per month. And if you’re switching from a brand to a generic, your insurer might suddenly change the rules mid-year. That’s why checking your plan’s formulary every few months isn’t paranoia—it’s necessary.

And then there’s drug cost savings, the financial benefit gained by using generic medications instead of brand-name equivalents. Also known as medication affordability, it’s the reason millions rely on generics to stay healthy. But savings only matter if you actually get them. A $5 generic sounds great—until your deductible is $2,000 and your plan only covers it after you’ve hit that number. Or if you’re paying $20 out-of-pocket because your pharmacy isn’t in-network. You’re not saving money—you’re just paying differently.

That’s where medication alternatives, different drugs used to treat the same condition when the first choice isn’t covered, effective, or tolerable. Also known as therapeutic alternatives, they can be lifesavers when reimbursement falls short. come in. If your plan won’t cover your usual generic, your doctor might switch you to another drug in the same class—like swapping amlodipine for lisinopril for blood pressure. But that’s not always safe. Psychiatric meds, thyroid drugs, and antibiotics? Small changes can break your treatment. That’s why knowing your options isn’t just about price—it’s about safety.

The posts below show you exactly how this plays out in real life. From how to check if your generic is truly covered, to why some pills lose potency when switched, to how to fight back when your insurer denies reimbursement—you’ll find real cases, real fixes, and real advice from people who’ve been there. No fluff. No theory. Just what works when your wallet and your health are on the line.

Pharmacy Reimbursement Models: How Laws Shape Generic Drug Payments

Discover how federal and state laws shape generic drug payments, why pharmacies struggle to stay open, and how the new Medicare $2 Drug List could change everything for patients and providers.

View More