When you get a prescription, you might assume your insurance will cover it - but that’s not always true. Some medications are covered fully, some cost more, and others aren’t covered at all. The reason? Your health plan uses something called a drug formulary. It’s not a secret code or a hospital policy you can’t understand. It’s a simple list - but knowing how it works can save you hundreds, even thousands, of dollars a year.

What Exactly Is a Drug Formulary?

A drug formulary is a list of prescription medications that your health insurance plan agrees to pay for, either partially or fully. Think of it like a menu of drugs your plan has approved. Not every medicine is on it. Some are preferred because they’re cheaper, safer, or work just as well as more expensive options. Others are left off because they cost too much or don’t offer enough extra benefit. These lists aren’t random. They’re created by teams of doctors, pharmacists, and health experts who review clinical data, patient outcomes, and real-world cost data. The goal? To make sure you get effective treatment without paying more than necessary. The system started in the 1960s, but it became standard after Medicare Part D launched in 2006. Now, nearly every private plan, Medicare Part D plan, and Medicaid program in the U.S. uses one.How Are Drugs Organized in a Formulary?

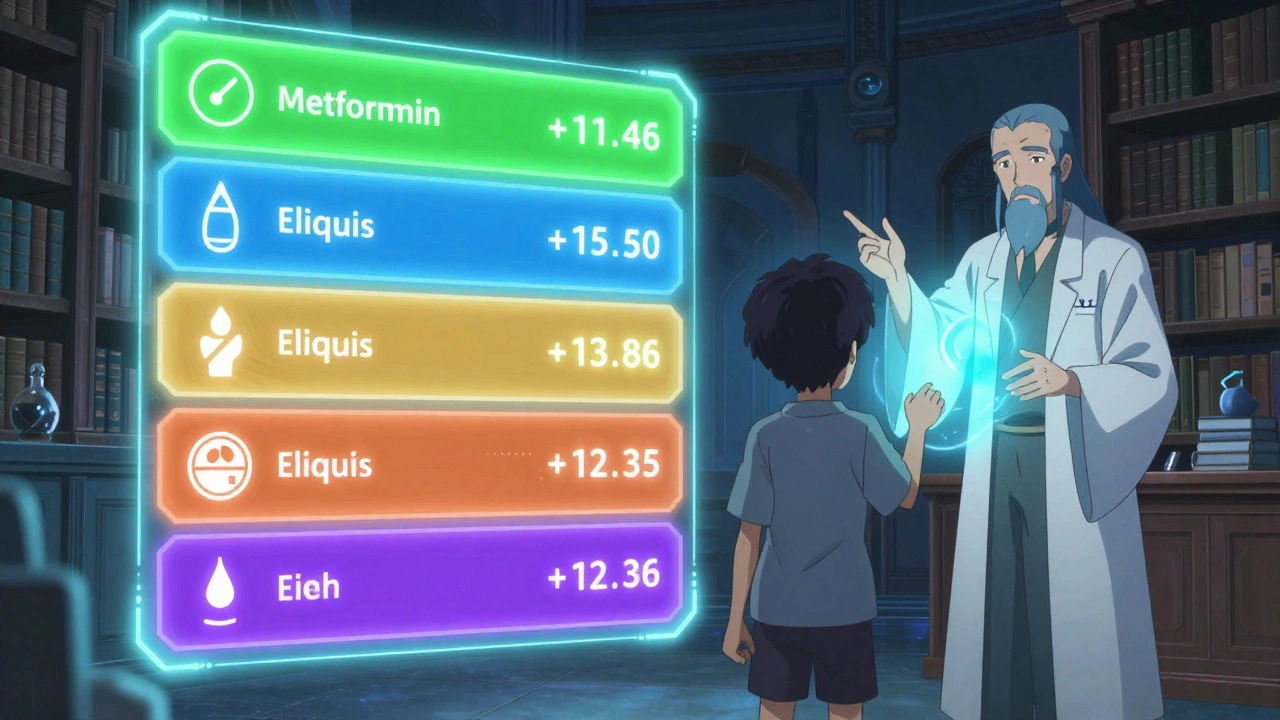

Most formularies use a tier system. Each tier has a different cost for you. The higher the tier, the more you pay. Here’s how it usually breaks down:- Tier 1: Generic Drugs - These are the cheapest. They’re chemically identical to brand-name drugs but cost way less. Most plans charge $0 to $10 for a 30-day supply. Examples include metformin for diabetes or lisinopril for high blood pressure.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications your plan prefers because they’ve proven effective and are priced reasonably. You’ll typically pay $25 to $50 per prescription, or 15-25% of the cost as coinsurance.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs that cost more and aren’t the plan’s top choice. You might pay $50 to $100 per fill, or 25-35% coinsurance.

- Tier 4: Specialty Drugs - These are high-cost medications for complex conditions like cancer, multiple sclerosis, or rheumatoid arthritis. Costs can range from $100 to $500 per month, or 30-50% coinsurance. Some plans even have a Tier 5 for the most expensive drugs - think $10,000-per-month treatments.

Some plans use names instead of numbers - like “Preferred Generic” or “Specialty Tier.” But the structure is the same: lower tier = lower cost.

Why Do Some Medications Get Moved Between Tiers?

Formularies aren’t set in stone. Every year, usually in January, plans update them. A drug you used to pay $10 for might jump to Tier 3 and cost $75. Why? - A new generic version hits the market, making the brand-name version less cost-effective.- A drug’s safety record changes after new side effects are reported.

- The manufacturer raises the price too high, so the plan drops it from preferred status.

- A better alternative becomes available with stronger clinical evidence.

For example, in 2023, one Medicare plan moved the diabetes drug glimepiride from Tier 2 to Tier 3 after a cheaper, equally effective generic became widely available. Patients saw their monthly cost jump from $30 to $85 - until they switched.

What Are Prior Authorization, Step Therapy, and Quantity Limits?

Even if a drug is on the formulary, your plan might still block it unless you meet extra rules. These are called utilization management tools:- Prior Authorization - Your doctor has to submit paperwork proving you need this specific drug. Maybe you’ve tried others first, or your condition justifies the higher cost.

- Step Therapy - You have to try a cheaper, approved drug before your plan will pay for the one your doctor prescribed. For example, you might have to try two generic painkillers before getting an expensive nerve pain medication.

- Quantity Limits - Your plan only covers a certain amount per month. If your doctor prescribes 120 pills but the limit is 30, you’ll pay out of pocket for the rest - unless you get an exception.

These rules aren’t meant to deny care. They’re meant to prevent overuse and waste. But they can be frustrating. One patient on Reddit said she had to try five different antidepressants before her plan approved the one her psychiatrist said would work. She waited six weeks - and her depression got worse.

What Happens If Your Drug Isn’t on the Formulary?

If your medication isn’t listed at all, you’re looking at full retail price - which could be $500, $1,000, or more per month. That’s not affordable for most people. But you’re not stuck. You can ask for a formulary exception. Your doctor submits a letter explaining why the non-formulary drug is necessary. Maybe you had bad reactions to all the alternatives. Maybe the formulary drugs don’t work for your condition. The plan has to respond within 72 hours - or 24 hours if it’s urgent. In 2023, 67% of Medicare Part D exception requests were approved. One patient with multiple sclerosis got her $12,000-a-month infusion therapy covered after her neurologist showed data proving other treatments failed. She paid only $95 - thanks to the exception.How Do Formularies Vary Between Plans?

This is the biggest surprise for most patients: two plans can cover the same drug differently. Take the blood thinner apixaban (Eliquis). In Plan A, it’s on Tier 2 with a $40 copay. In Plan B, it’s on Tier 3 with a $120 copay. In Plan C, it’s not covered at all - you’d pay $550 out of pocket. Medicare Part D plans must cover at least two drugs in each major category, but beyond that, they’re free to choose. A 2022 Kaiser Family Foundation study found that identical prescriptions could cost anywhere from $15 to $150 a month depending on the plan. That’s why comparing formularies during open enrollment is critical. If you take three medications, even a small change in tier placement can add up to $1,200 extra per year.

What Should You Do as a Patient?

You don’t need to be an expert to navigate this. Here’s what to do:- Check your formulary before you fill a prescription. Most insurers post their full list online. Search for your exact drug name - including brand and generic versions.

- Use the Medicare Plan Finder if you’re on Medicare Part D. It’s updated every October for the next year’s coverage. Enter your meds, zip code, and pharmacy - it shows you the cheapest plan.

- Ask your pharmacist. They can tell you if your drug is on formulary and what your cost will be before you pay.

- Review your plan every year during open enrollment (October 15 to December 7 for Medicare). Don’t assume your meds will stay the same.

- Request an exception if needed. If your drug’s not covered or you’re stuck with step therapy, talk to your doctor. They can help you file the paperwork.

According to a 2024 GoodRx survey, 68% of insured adults check their formulary before filling prescriptions. Of those, 42% switched medications because of cost. You don’t have to be one of the 31% who got hit with an unexpected bill because they didn’t check.

Recent Changes That Affect You in 2025

New rules are making formularies fairer:- Insulin cap - Since 2023, Medicare Part D plans can’t charge more than $35 a month for insulin. This applies to all brands.

- Out-of-pocket cap - Starting in 2025, your total yearly drug costs (including what you pay) will be capped at $2,000. That’s huge for people on expensive treatments.

- Biosimilars - More generic versions of biologic drugs (like Humira or Enbrel) are being approved. These are cheaper, and formularies are adding them fast.

- Therapy management - New Medicare beneficiaries now get a free session with a pharmacist to walk through their formulary and meds.

These changes don’t eliminate formularies - but they make them more patient-friendly. The goal isn’t to control costs at your expense. It’s to make sure you get the right drug, at a price you can afford.

Real Stories: When Formularies Help - and Hurt

One woman on Facebook shared: “I was terrified about my cancer drug. The list price was $5,000 a month. But it was on Tier 4 of my plan - my copay was $95. I didn’t have to choose between medicine and rent.” Another said: “My asthma inhaler moved from Tier 1 to Tier 3. My cost jumped from $10 to $70. I had to switch - and my breathing got worse for months.” Formularies aren’t perfect. But when used well, they help patients get life-saving drugs at prices they can manage. The key is knowing how to use them - and when to push back.Is a drug formulary the same as a prescription list?

Yes, a drug formulary is often called a Preferred Drug List (PDL) or prescription list. It’s the official list of medications your health plan covers. But it’s not just a list - it includes rules like tier levels, prior authorization, and step therapy that affect how much you pay and whether you can get the drug at all.

Can I get a drug that’s not on my formulary?

Yes, but you’ll likely pay full price unless you get a formulary exception. Your doctor can request an exception if the drug is medically necessary and alternatives either didn’t work or caused side effects. Approval rates for these requests are around 67% for Medicare Part D plans.

Why do formularies change every year?

Formularies change because new drugs enter the market, generics become available, drug prices shift, or safety data updates. Insurance plans update their lists annually to keep costs down and ensure patients get the most effective, affordable options. Changes can happen mid-year too, but you must be notified 60 days in advance.

Do all insurance plans have the same formulary?

No. Every plan creates its own formulary. Two plans might cover the same drug, but one might put it on Tier 2 (low cost) and another on Tier 4 (high cost). That’s why comparing plans during open enrollment is so important - especially if you take multiple medications.

What’s the difference between generic and brand-name drugs on a formulary?

Generic drugs are chemically identical to brand-name versions - same active ingredient, same dose, same safety profile. They’re just cheaper because they don’t include marketing or patent costs. Formularies put generics in Tier 1 because they save money without sacrificing effectiveness. Brand-name drugs are placed higher on the formulary if they offer a clear clinical advantage over generics.

How do I find my plan’s formulary?

Log in to your insurance provider’s website and search for “formulary” or “drug list.” Medicare beneficiaries can use the Medicare Plan Finder tool. Your pharmacy can also check it for you before you fill a prescription. Always verify your drug’s status each time you refill - changes can happen anytime.

![Ventodep ER (Venlafaxine XR): Uses, Dosage, Side Effects, Interactions [2025 Guide]](/uploads/2025/08/thumbnail-ventodep-er-venlafaxine-xr-uses-dosage-side-effects-interactions-2025-guide.webp)

Jim Irish

10 December, 2025 . 19:10 PM

This is the kind of info every patient needs to know before signing up for a plan

Mia Kingsley

12 December, 2025 . 09:00 AM

so like if my insulin is on tier 4 i just pay 35 right?? wait no i thought that was only for medicare?? someone pls fix my brain

Katherine Liu-Bevan

13 December, 2025 . 17:26 PM

Formularies are complex but they’re not arbitrary. The tier system exists because pharmacoeconomic analysis shows that switching patients to generics or preferred brands often leads to better adherence and lower overall costs. What’s missing from most explanations is how formulary decisions are tied to real-world outcomes - not just price tags. For example, a Tier 2 brand might be preferred not because it’s cheaper but because it has fewer drug interactions in elderly patients. Always ask your pharmacist for the clinical rationale behind tier placement - they’re trained to explain it.

Courtney Blake

15 December, 2025 . 06:35 AM

why do we even have this system? in canada we just get the drug and pay a flat fee. why are we making people jump through hoops just to survive? this is capitalism at its worst

Kristi Pope

16 December, 2025 . 00:42 AM

I used to think formularies were just about saving money for insurance companies until I saw my mom’s out-of-pocket costs drop from $200 to $15 a month after switching to a generic. It’s not perfect but when it works right it lets people keep taking their meds without choosing between rent and refills. Just wish more people knew how to use it

Regan Mears

17 December, 2025 . 22:29 PM

Don’t forget to check your formulary during open enrollment - even if you’re happy with your plan. Last year my asthma med moved from Tier 1 to Tier 3, and I didn’t notice until I got billed $85. Now I print out my drug list every October and compare it side-by-side with last year’s. Took me five years to learn this, don’t make my mistake.

Neelam Kumari

19 December, 2025 . 10:31 AM

hahahaha oh sweet summer child. you think the 67% approval rate means anything? my cousin got denied 3 times for a cancer med they said was "not cost-effective" then got approved on the 4th try after a lawyer got involved. this system is rigged

Queenie Chan

21 December, 2025 . 01:57 AM

Just had a pharmacist walk me through my formulary last week - it felt like getting a map in a maze I didn’t even know I was lost in. Turns out my migraine med was on Tier 3 because there’s a biosimilar now that’s 70% cheaper and just as effective. I switched. Saved $120/month. Who knew formularies could be your secret weapon? Thanks for the breakdown - this should be required reading in high school.