Medical Debt Rights: Know Your Protections and How to Fight Back

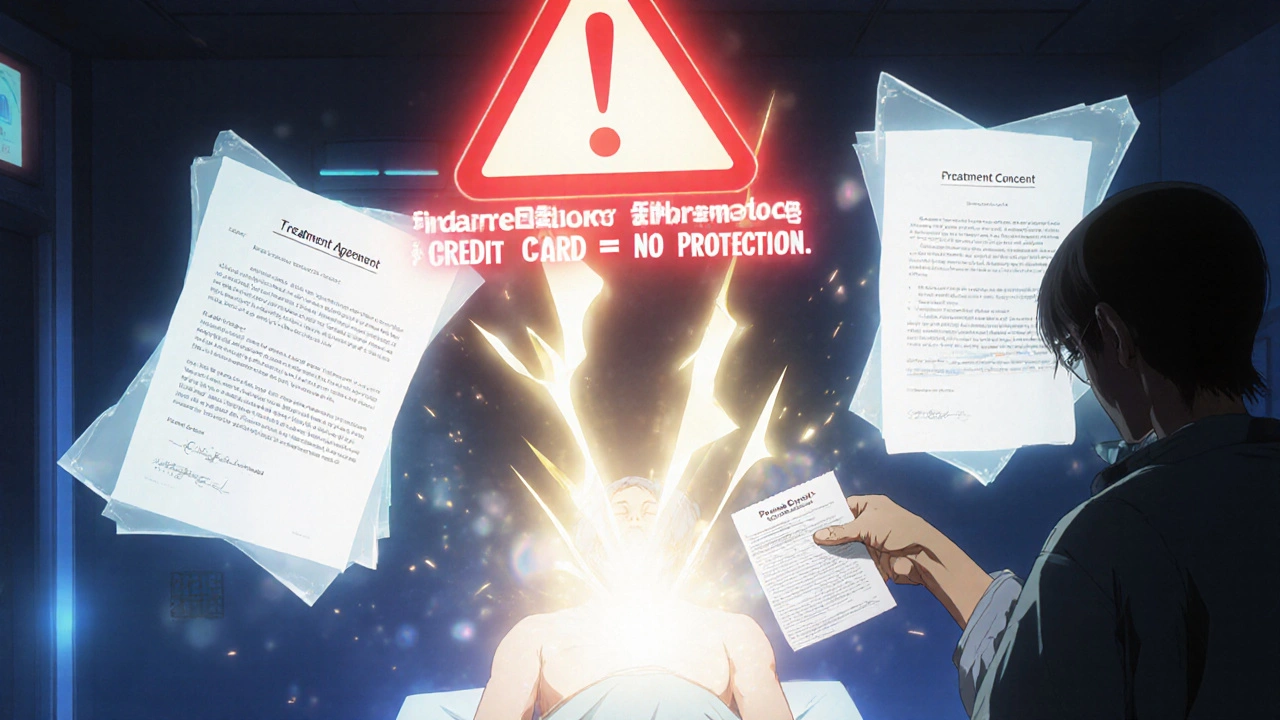

When you’re hit with a medical bill you can’t pay, it’s not just about money—it’s about medical debt rights, the legal protections patients have against unfair billing, aggressive collection, and hidden fees. Also known as patient financial rights, these rules exist to stop hospitals and debt collectors from pushing people into crisis just because they got sick. You don’t have to accept every bill you’re handed. Many are wrong. Many are inflated. And many violate federal and state laws designed to protect you.

Behind every medical debt is a system full of gaps: hospitals that bill before insurance clears, collectors that add fees no one told you about, and PBMs and billing companies that inflate prices to make more profit. But you’re not powerless. medical billing errors, mistakes in coding, duplicate charges, or services you never received are shockingly common—studies show up to 80% of bills have at least one error. debt collection laws, including the FDCPA and the No Surprises Act give you the right to dispute, request itemized statements, and stop collectors from harassing you. And if your income is low, healthcare financial assistance, hospital charity care programs required by law can wipe out or slash your bill—no credit check needed.

You don’t need a lawyer to start fighting back. Just know your rights: you can ask for a payment plan before your bill goes to collections, you can challenge any charge you don’t recognize, and you can’t be sued or reported to credit bureaus without proper notice. Some states even ban medical debt from appearing on credit reports entirely. The real issue isn’t always how much you owe—it’s whether the system treated you fairly.

Below, you’ll find real-world guides that show you exactly how to handle medical debt—from spotting billing tricks to negotiating with hospitals, understanding what’s legally enforceable, and getting help when you’re overwhelmed. These aren’t theoretical tips. They’re steps real people have used to erase thousands in debt without going broke.

Consumer Protection Laws for Patients: What You Need to Know in 2025

New York's 2024 patient protection laws ban surprise billing, forced financing, and combined consent forms. Know your rights when paying for medical care-and how to avoid medical debt traps.

View More